Mortgage Automation Tool to

Improve

Our solutions help you take sound decisions with the speed needed to stay ahead of your competitors

MSuite is an intelligent OCR based tool built to automate several mortgage back-office processes including document indexing, data extraction and manual stare & compare. Equipped to handle different documents types including unstructured documents, it integrates seamlessly with leading Loan Origination Systems and can be customized to fit unique workflows. The tool can be further used to automate parts of Mortgage Underwriting. It reviews Credit, Income and Asset of borrowers to give lenders an upfront view of whether or not the loan is worth further processing.

MSuite can be used to automate a range of mortgage processing tasks. These include:

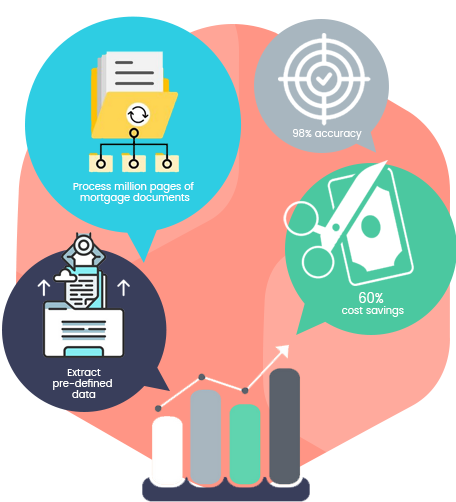

MSuite has been extensively used to process loans for lenders and credit unions. The tool has:

As an advanced automation tool, MSuite helps to: